SSB - Predicting future SSB interest rates

According to MAS FAQ, it said "The SSB on offer in any given month are linked to the daily average SGS yields as published by MAS in the previous month"

Where to get SGS historical data? You can find it here -> SGS Prices and Yields - Benchmark Issues

Let's perform an example on SBAUG22 SSB which has 3% returns

For SBAUG22 SSB, it is based on the yield on JUN.

On the SGS Prices and Yields - Benchmark Issues, configure the following fields to get daily frequency of JUN 2022 Yield

If you are calculating manually, the above will be

Sum of yields = 65.94

number of day = 22

Estimate SBAUG22 SSB = 2.9973% (round up)

Alternatively, and for simplicity, I will copy the yield value and paste it to Excel, as follows

Highlighting all the yield value will immediately calculate an average for you.

And as you can see, the average is 2.9973 which is a round up of SBAUG22 SSB 3% average return over 10 years.

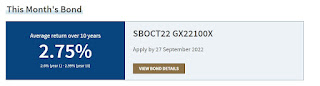

So, using this to predict OCT SSB rate based on AUG SGS 10 years yield at SEP SSB closing date at 26 Aug.

The OCT SSB will be lower to 2.70%. However, as this is on the 26th Aug, there will still be 3 more working days for calculation (29th, 30th and 31th Aug). This rate may go up if there is high yields on those 3 days. Let's see.

Comments

Post a Comment